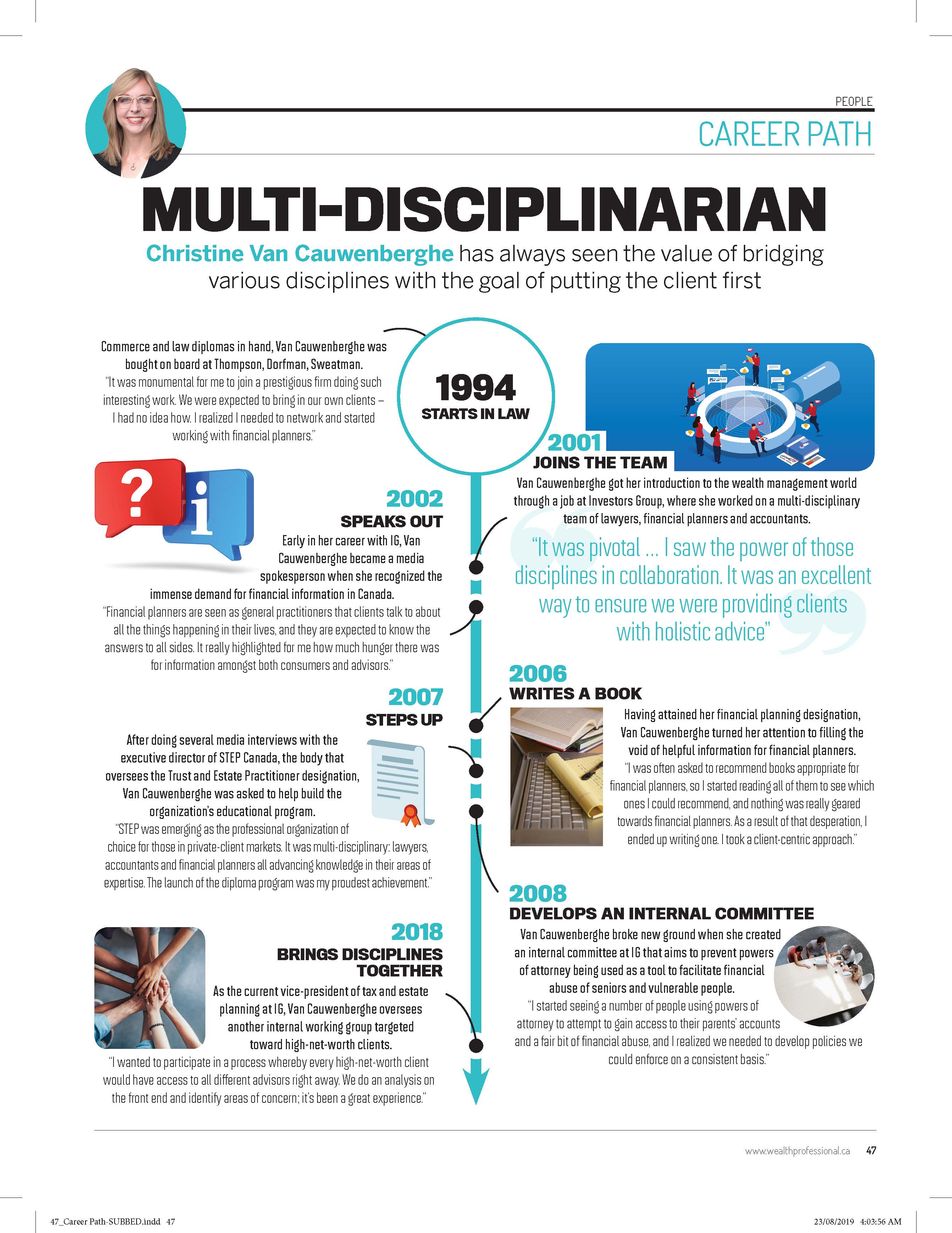

Before joining IG Wealth Management more than 20 years ago, Christine Van Cauwenberghe practiced tax law at a large firm in Winnipeg. While there, she encountered many families that could have avoided both personally and financially costly outcomes had they “received the right advice at the right time.”

Knowing there had to be a better way to deliver proactive and comprehensive advice, she saw she could make a meaningful difference at IG. Today, Christine leads a diverse team of tax, estate, and financial planning experts, who support IG Advisors and help high-net-worth clients put the futures they envision into motion.

Ensuring goals become reality

The drive to find a better way has always inspired Christine to push beyond the limits.

When she saw a void in how financial advisors were instructed to address the unique needs of their clients, she authored Wealth Planning Strategies for Canadians, an annual publication by Thomson Carswell that takes a client-first approach to how complex problems are solved.

“Financial planning is much more than creating an investment plan,” she says. “It’s about looking at your life goals and working backward to ensure you’re financially prepared to make your goals a reality. We strive to be the destination of choice for all Canadians with complex financial needs, whether you’re a business owner, retiree, or caring for your loved ones.”

This includes protecting vulnerable persons from financial abuse, which Christine addresses through her work with the Alzheimer’s Society—a non-profit partner of IG—and an internal committee she developed to prevent powers of attorney from being used unlawfully.

Planning for success as a team

Christine’s multidisciplinary experience has given her a deep understanding of what financial advisors and her team need to succeed.

She knows that “the best advice is made possible through consistent collaboration.” By prioritizing a cohesive setting, Christine enables experts to share their opinions as a team so that financial advisors can effectively integrate their ideas. This has been critical in enabling financial advisors to develop the long-lasting and loyal client relationships that are so valued at IG Private Wealth Management.

“We take a team-based approach to ensure our clients’ needs are met at all stages and continuously educate them so that they can feel confident in their decisions. People often assume that financial planning should begin when you’ve reached a certain age or milestone, but it really is for everyone. It’s a lifestyle change that comes from many small adjustments over time, which leads to a better outcome.”