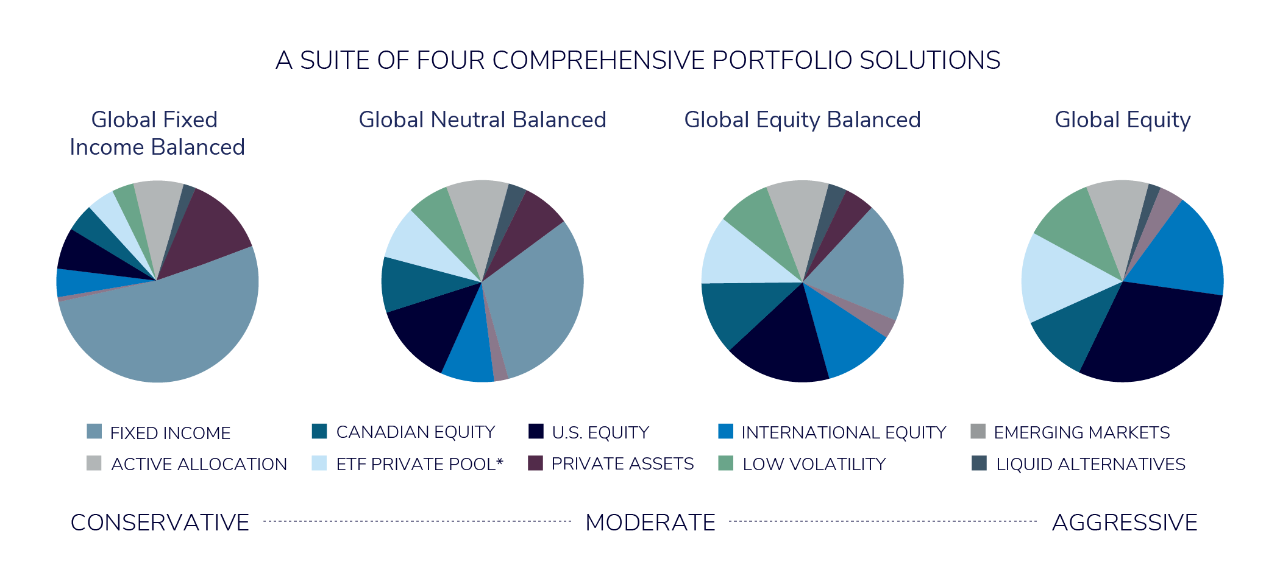

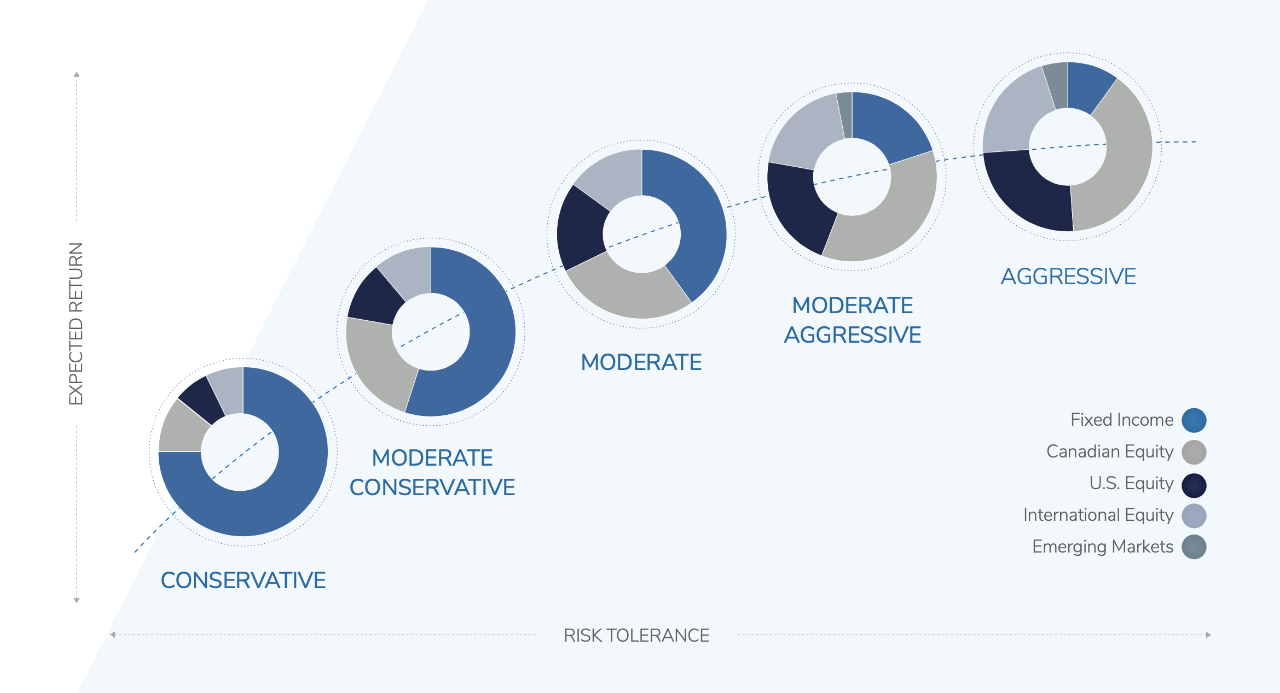

Disciplined asset allocation

iProfile Portfolios are built on the investment theory of strategic asset allocation. We determine the right allocation to different asset classes for each portfolio. These asset classes could include bonds, stocks and alternative investments, from Canada and other key markets across the globe.

Portfolios are rebalanced regularly to maintain the appropriate mix of assets, to ensure that the agreed level of risk remains consistent.