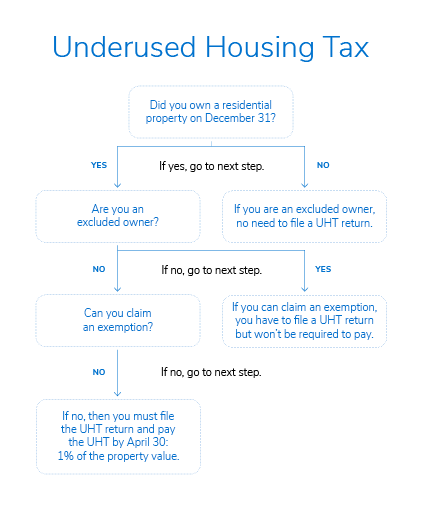

If you own a residential property in Canada, you might have to pay an Underused Housing Tax (UHT) if it was vacant or underused. Even if you’re not subject to tax, you may be required to file an Underused Housing Tax return to claim an exemption.

The UHT is an annual 1% tax on the value of underused or vacant residential property in Canada. The deadline for the first ever UHT returns (for persons who owned property on December 31, 2022) was extended to April 30, 2024, but subsequent returns will be due on April 30 of the following year. For example, 2023 returns will be due April 30, 2024, 2024 returns will be due April 30, 2025, and so on.

The introduction of the Underused Housing Tax

The federal Underused Housing Tax Act came into force as of January 1, 2022, and applies a 1% tax on the value of underused or vacant residential real estate in Canada held by non-resident, non-Canadian owners. The property’s value is based on the greater of the assessed value or the most recent sale price on or before December 31 of that year.

When the UHT was first proposed, it was thought that this tax would only apply to non-resident/foreign owners of Canadian property. As it turns out, some Canadians will also be required to file a return (even if they don’t have to pay the UHT), otherwise they could face significant penalties. This is because the definition of “excluded owner” doesn’t include some typical ownership structures.

Here is a general overview of who has to file a return and what exemptions may be available.

Who has to file a return?

All registered owners, unless they are an excluded owner, are required to file a return (the new UHT-2900) along with a complete declaration of current use for each Canadian residential property they own.

An excluded owner includes:

- A Canadian citizen or permanent resident, except to the extent that the individual is an owner of the residential property in their capacity as a trustee of a trust (other than a personal representative in respect of a deceased individual) or as a partner of a partnership.

- A publicly traded Canadian corporation.

- A trustee of a widely-held trust, mutual fund trust or real estate investment trust.

- A registered charity, co-operative housing corporation, municipal organization, public institution or governing body.

This list has some notable exceptions; all private corporations, partnerships and trusts, as well as people who are not Canadian citizens or permanent residents are required to file a return and then determine whether they can claim an exemption to avoid paying the UHT. If a residential property has multiple owners, each owner must determine if they are required to file a return and qualify for an exemption.

If an owner does not file a UHT return, they will be subject to a minimum penalty of $5,000 per form if the owner is an individual, or $10,000 in all other cases.