2022 Market Outlook

From rapid reopen to normalization

“Strangely enough, this is the past that somebody in the future is longing to go back to.”

Ashleigh Brilliant

After the rapid reopen, the path to normalization

A year ago, many countries were managing through their second wave of COVID-19 infections. Many equity markets nevertheless had staged a full and complete recovery to their pre-COVID highs. Despite the equity recovery, investors were still nervous. A year ago, we had just started to hear news of pending approvals of COVID vaccines.

Vaccines provided an opportunity for an economic re-opening. Governments and central banks around the world supported the re-opening with trillions of dollars in fiscal and monetary support. Economic growth was stronger than anticipated. Corporate earnings were better than predicted. And equity market returns were higher than consensus predictions. That begs the question, with that environment exceeding expectations in 2021, what does 2022 hold for investors?

I believe 2022 will offer a continuation of healthy economic growth, generally positive equity markets (albeit with valuation challenges) and a higher interest rate environment proportionate to the prevailing higher inflation. To put it concisely, I offer three themes to the 2022 outlook.

From rapid reopen to normalization - The global economy

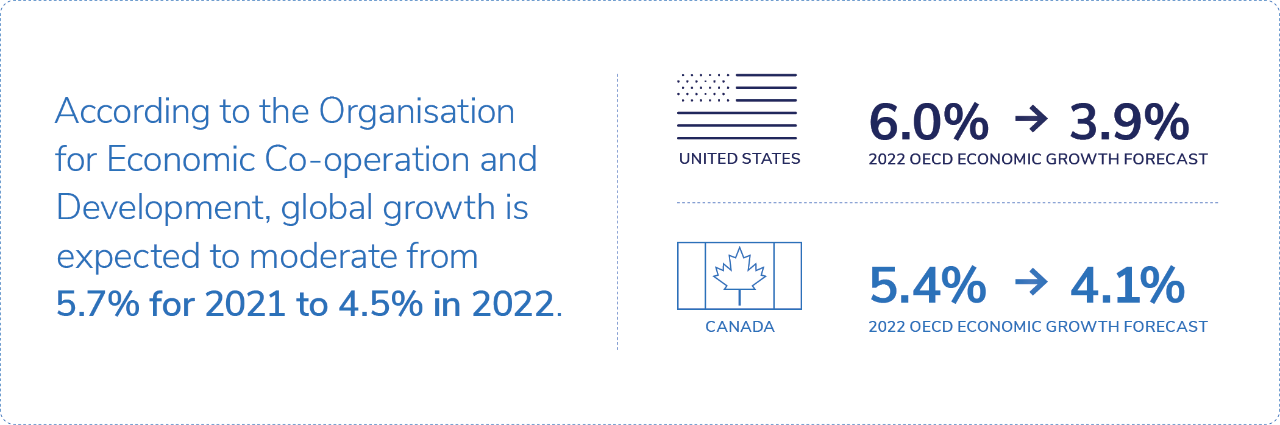

If I describe 2021 as the expansionary rapid reopen, which was supported by an excess of $16 trillion (USD) in fiscal and monetary stimulus globally, then 2022 may be best described as the path to normalization. We saw accelerating economic growth in 2021. Moderation of growth from current levels is entirely normal at this stage of the recovery. However, slower growth doesn’t mean low growth. Rather, what is more likely to transpire is a transition from high growth to normal growth.

We continue to hear reports of tight supply across multiple industries. I would suggest the tighter supply-chain is a better indicator of economic strength than weakness. Supply chain disruptions will take some time to catch up to accumulated demand. Additionally, low inventory levels will need to be rebuilt. This combination of tight supply, low inventories and higher demand leads to the expectation that the 2022 global economy will remain healthy. And while there are economic conditions that could cause some volatility, for example: shorter-term negative growth consequences of the supply-chain issues, disruptive resurgences of COVID cases and variants, or a slowing Chinese economy, I believe for the bulk of 2022, the risks are to the upside.

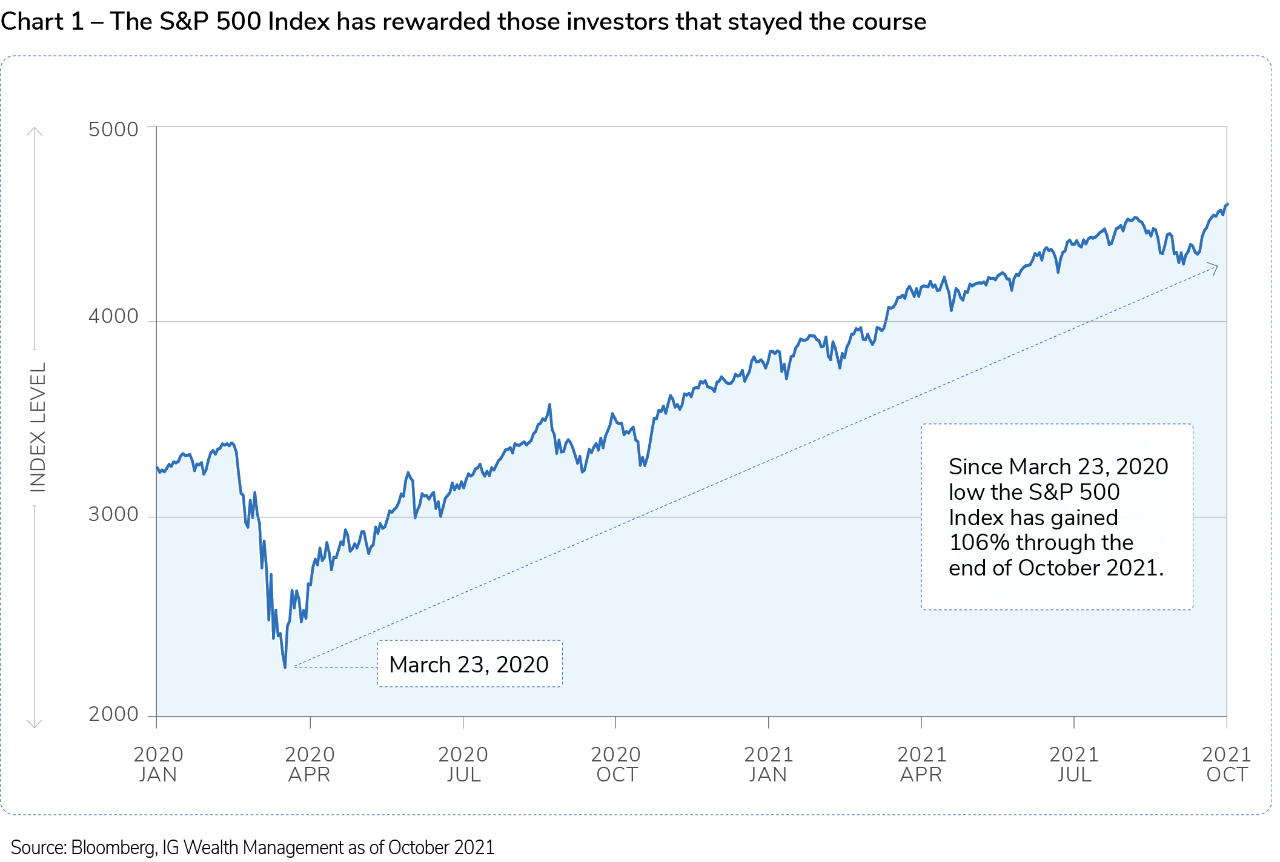

After a strong 2021, equity market returns will be much closer to average

Following another great year in equity markets driven by resurging earnings growth, low interest rates and plenty of liquidity, many investors may be asking themselves, “what’s left?” The simple answer is, well, quite a bit, actually. We shouldn’t think of the markets in terms of linear movements. For example, just because U.S. equities have doubled since the low on March 23, 2020 (as measured by the S&P 500 Index), it doesn’t mean equities must be “due” for a bad year. Rather, investors need to consider the economic environment (highlighted above), the earnings potential of companies and valuation. In this regard, we would argue that while a market correction is always a possibility, it would also be well within the context of normal market activity and is less likely to indicate some more ominous environment ahead.

“The S&P 500 Index has doubled since the low reached on March 23, 2020. Many investors believe a strong rally must lead to a correction. That is not necessarily the case.”

I believe 2022 will be another year of reward for equity investors. Returns are less likely to be as strong as they have been in 2021 as earnings growth moderates and valuation responds to a higher inflation and interest rate environment. The wide differences in valuation across markets may also lead to a wider range of outcomes.

U.S. equity investors have enjoyed strong returns through the recovery. As I believe we are entering the normalization phase of the economic recovery, I also believe we are entering the normalization phase of the market recovery.

Stock market returns in any given year are a balance between earnings growth and a change in valuation. As earnings growth advances, we must consider that equity returns will be muted by a valuation contraction. This is typically what happens over time between inflation and valuation. Historically, as inflation rises, stock market valuations tend to fall. This is by no means a perfect relationship, but it is one that eventually reasserts itself over time.

The current level of inflation (which we will discuss further on) and valuation for the S&P 500 Index would suggest that U.S. equities may be prone to a continued valuation contraction. This should not be taken as a sign of any potential near-term market volatility. Valuation has proven itself to be a terrible predictor of short-term market performance. Rather, this lends itself to the “average-return” expectation due to lower valuations.

The economic normalization narrative that has been laid out through this outlook extends to the international markets as well. The path from rapid reopen to normalization is global. Similarly, the strength in manufacturing and earnings growth is also global. However, when we compare valuation across geographic markets, we see a marked deviation between the U.S.-based S&P 500 Index, and other major indices. While valuation is a poor predictor of short-term returns, the valuation benefits that international equities offer are attractive at a time when the expansion appears to be shared globally.

Resurgent oil to boost Canadian equities

Canadian investors were rewarded by the strong correlation between oil prices and the S&P/TSX Composite Index in 2021 as oil gained 72% for the year through October 2021 (as measured by the benchmark West Texas Intermediate price for crude). While the energy sector was not the sole driver of performance, its contribution has been significant. As is typical, when oil prices are up strongly on a year-over-year basis, the TSX tends to respond in kind. Looking ahead to 2022 and the potential for the TSX, we need to think about the continued prospects for oil.

Global crude supply remains tight while demand has recovered. According to the U.S. Department of Energy’s Energy Information Administration, global daily consumption has increased from an average of 92 million barrels per day (bbl/d) for 2020, to an average of 98 million bbl/d for 2021 (through October), while supply remains constrained at 95 million bbl/d. Without a willingness by OPEC+ to increase production, which the coalition seems to have no appetite to do for the time being, crude prices may see further upward pressure into 2022. Continued price appreciation for oil bodes well for the TSX.

Beyond the boost from oil, the S&P/TSX Composite Index looks attractive. Valuations remain in-line relative to the 10-year average for the index while earnings growth into next year should be supported by strong profit margins. The financials sector, which represents approximately 32% of the index, is trading at attractive levels. And given expectations of a rising interest rate environment, financials are expected to contribute positively to market performance in 2022.

The only question mark remains the Canadian dollar. Relative to its long-term correlations, the Canadian dollar is undervalued to the U.S. dollar by a wide margin. Historically, the CAD/USD relationship tends to be a function of oil prices and the difference in interest rates between the two countries. Gains in oil prices tend to result in gains in the value of the loonie. This hasn’t been the case in the latter half of this year. If we use an average price per barrel of crude of US$75 the Canadian dollar should be valued closer to US$0.87. Recently however, the Canadian dollar has decoupled from the value of oil. Should this relationship reassert itself we should expect the Canadian dollar to move higher to its suggested fair value.

Currently, expectations between the Bank of Canada and the U.S. Federal Reserve in terms of the timing of interest rate increases would also suggest a higher value for the Canadian dollar relative to the greenback. Combining these two historical relationships suggest a target range for the Canadian dollar of US$0.83 – 0.85 over the next 6-12 months.

The bond markets in 2022 will be about inflation – and what central banks are going to do about it.

If there was an overused word during 2021, transitory might be it. Transitory was the word used to describe the current inflationary environment. Or perhaps, misused at least in the way some hoped it would be. The belief a year ago was that any inflation increase would be only temporary. As the year went on, the transitory narrative became harder and harder to justify.

Those in the transitory camp attempted to explain higher inflation away with base effects, used car prices, airline fares, anything that was a plausible reason for temporarily high inflation. As the base effects faded away inflation pushed higher still. The higher inflation has been a function of economics – low interest rates, higher consumer demand, tighter supply and more money in circulation.

The massive amount of fiscal and monetary stimulus that governments and central banks injected into the global economy to provide a safety net during the COVID lockdowns left the residual impact of inflation. As a result, we have likely hit a new inflation paradigm distinct from the last decade.

From the bond markets perspective, 2022 is likely to be a repeat of 2021, as interest rates grind higher. The base case is for the Federal Reserve to end its tapering of bond purchases by June followed by two rate increases in the back half of the year. The risk is that the Fed accelerates the taper and raises rates much more swiftly before year end. With the Bank of Canada further along in its tapering of bond purchases and already suggested forthcoming rate increases, we could see a faster path to rate normalization here than in the U.S.

What this suggests is a low-single digit potential for bond returns in 2022. A diversified approach to fixed income, including areas with higher yield potential such as emerging market debt, high yield and investment grade corporate bonds may provide a higher return potential while balancing out the interest rate risks.

Overall, 2022 looks to be another good year for investors

At some point in the future, we will look back at what has transpired over the past couple of years and remark at how strong the economic recovery was and how strong the markets responded. Investors have enjoyed a very prosperous environment.

The data would suggest that the environment in 2022 will further improve upon 2021. That doesn’t mean that 2022 will be without risk. A market correction is certainly possible, if not expected for 2022. However, an understanding of where we are in the economic cycle, diversifying our portfolios to take advantage of the opportunities and utilizing active management will help manage those risks.

The new year looks to be an extension of 2021, but perhaps milder. By all accounts, economic growth is expected to remain robust, yet measured. The equity bull market is likely to march on, just at a slower pace. And interest rates should continue their move higher commensurate to the prevailing inflation. Overall, expectations for 2022 are for another rewarding year for investors as we continue to return to a more normal environment.

Chief Investment Strategist, IG Wealth Management

Philip Petursson

Philip is an established thought leader within the wealth management industry, having spent more than 25 years working for prominent financial institutions in a variety of senior leadership roles. He is recognized for his accessible approach to investment advice and regularly shares his insights in the media, through frequent press, radio and television appearances.